Guest Post: On Decentralized Physical Infrastructure Networks (DePIN)

DePIN captures the value of physical infrastructure in the form of real world assets (RWA) through tokens. In a bottom-up self-organized way, it attracts users through economic mechanisms and gives full play to the economies of scale of the distributed economy.

Written by Wang Puyu and Zou Chuanwei of Hashkey Tokenisation, translated by IoTeX's Andrew Law

What if we could purchase standardized small devices (like wireless routers) at an extremely low cost and these devices could communicate and network with similar nearby devices, even those bought by people in different countries and regions, thus forming huge physical infrastructure networks (like storage, communication, data networks, etc.)? What changes would this bring to the industry? With a standardized small device, anyone could become the co-builder of a network, while also owning the benefit rights and governance of the network. And for users, they can use these networks or data services anytime, anywhere, without permission and at extremely low costs. The high-frequency usage of the network or data services by users can also continuously bring passive income to the network builders. Without centralized institutions for organization and coordination, or complex approval processes, a huge people-owned infrastructure network is built. This seems difficult to achieve, yet it is happening rapidly around us. This new type of economic activity has a new term – Decentralized Physical Infrastructure Network (DePIN).

I. What is DePIN?

DePIN is a new Web3 term derived on the basis of PoPW (Proof of Physical Work), MachineFi and others. DePIN (Decentralized Physical Infrastructure Network) refers to using token economics to incentivize and coordinate community members to bootstrap various physical infrastructure networks, following the principle of "the more contributions, the more rewards."

Learn more: What are Decentralized Physical Infrastructure Networks (DePIN)?

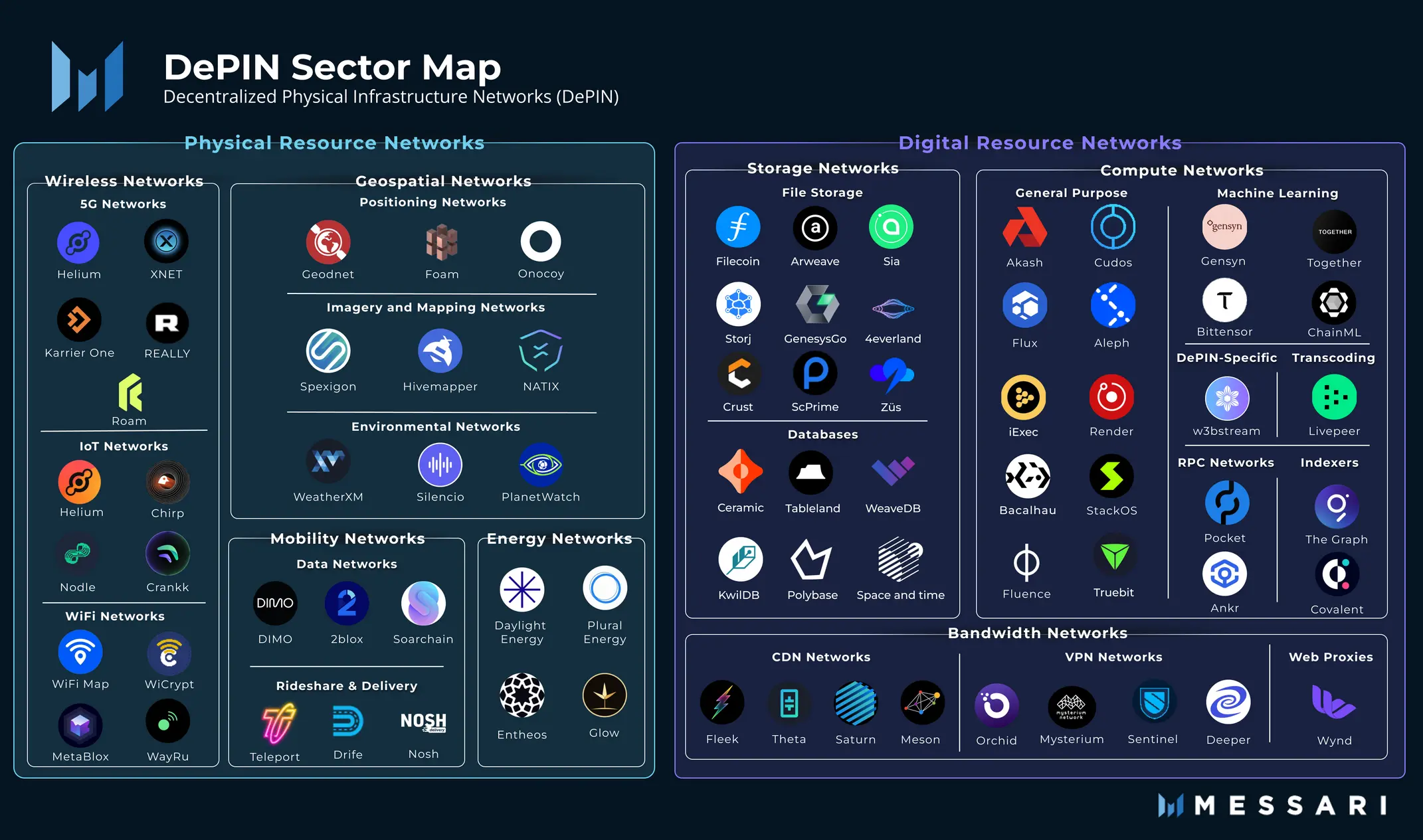

Messari categorizes the DePIN sector into two major sections: 1) physical resource networks comprising wireless, geospatial, mobility and energy networks; 2) digital resource networks including storage, compute and bandwidth networks.

II. Why DePIN?

In building digital infrastructure, DePIN fully utilizes the advantages of cryptocurrency in distributed organizations, using a bottom-up, low-cost and efficient organizational approach to achieve rapid network expansion, overcoming the inherited problems of top-down approach associated with high spending and low efficiency.

- Traditional Centralized Physical Infrastructure Networks (CePIN)

Infrastructure network construction usually involves high costs and many years. For example, from 2017 to the end of 2021, China has built and opened a cumulative total of 1.425 million 5G base stations, costing 184.9 billion RMB.

- Decentralized Physical Infrastructure Networks (DePIN)

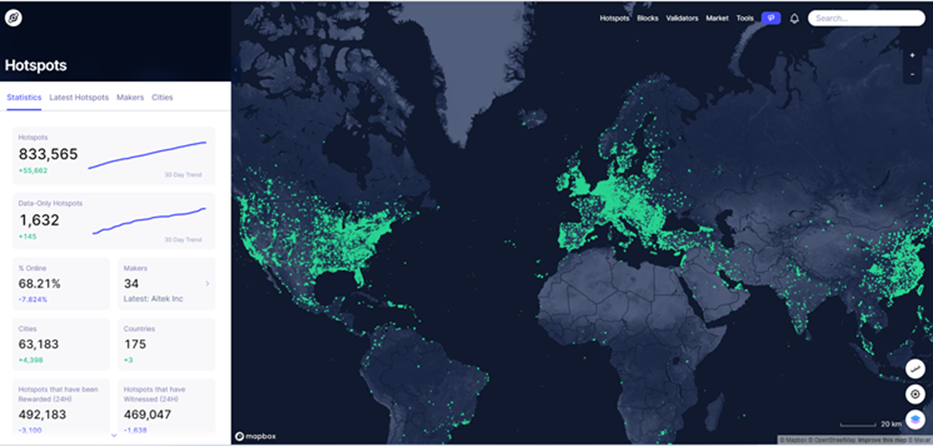

In just 31 months, Helium has deployed 833,000 small base stations (hotspots) in a distributed manner, covering 175 countries, and has maintained a growth rate of 30,000 hotspots per month. Compared to CePIN, the initial construction costs of DePIN can be neglected.

Without judging whether Helium's business model is successful, Helium's sustained growth rate of 30,000 hotspots per month over the past 3 years with almost negligible operating costs proves the feasibility of the DePIN paradigm.

III. How do you deploy a DePIN?

We further explore how to deploy a DePIN from two aspects – the constituent elements of the DePIN ecosystem and the economic model.

Essential components of DePIN economy

The six essential components of the DePIN ecosystem include physical hardware, incentive mechanism, consensus protocol, contributors, tokens and DAO community.

A. Physical hardware

Physical hardware can be defined as DePIN Unit (DU), which is usually an IoT device that connects the physical world to the digital world in the DePIN network. Taking faster growing projects on the market as examples, the DU of distributed street view mapping, i.e. Hivemapper is a standardized dashcam, the DU of LoraWAN network, i.e. Helium is a network miner (hotspot), and the DU of renewable energy network, i.e. Arkreen is a solar photovoltaic panel. To ensure frictionless participation by contributors from different regions, backgrounds and consensus in building DePIN under distributed organization, DU needs to meet the following conditions as much as possible:

- DU shall be standardized and plug-and-play

- Contributors shall not need frequent maintenance of DU

- DU costs shall be inversely proportional to network scale, so DU costs shall be reduced as much as possible. Currently DU prices for different projects are controlled between $200-500.

B. Incentive mechanism

The incentive mechanism is key to the rapid growth of DePIN projects. The project needs to align incentive mechanisms to the contributors' behavior goals, in order to achieve scalable infrastructure network development. In addition, the project first needs to formulate appropriate reward standards for the scalable development of the infrastructure based on the infrastructure type. For example, to expand the coverage area of the network, Helium's rewards in areas with lower network coverage density are higher than in areas with higher density. To prevent misconduct, rewards are also unavailable in areas with excessively low coverage density. As a result, for higher returns, rational miners will usually choose to deploy Helium miners in moderately dense areas. Similarly, Arkreen incentivizes contributors based on power generation capabilities, so rational contributors will install miners in ideal sunlight locations. In general, the design of incentive mechanisms needs to follow these principles:

- The project shall have clear overall and sub-goals. There is only one overall goal, but there can be multiple sub-goals. But each additional sub-goal exponentially increases the difficulty of understanding the project.

- Different contributors shall have definite behavioral reward standards (X to Earn). There should not be too many types of contributors, and each additional X to Earn increases system complexity.

- The distribution quantity shall be designed with rules based on total market circulation, to avoid token over-issuance leading to price drops.

C. Consensus mechanism

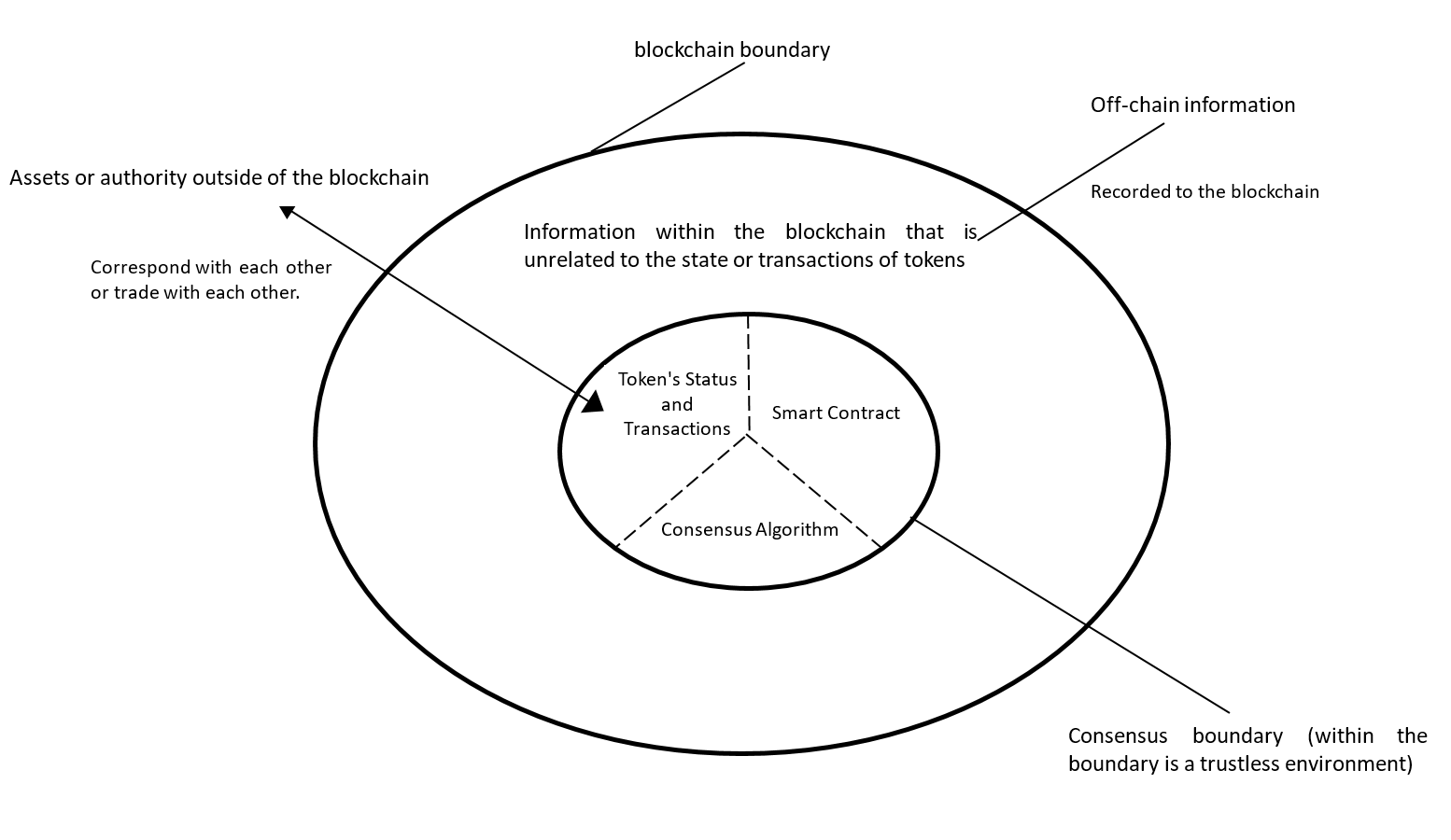

CePIN is deployed and developed under the absolute control of centralized institutions. But DePIN is distributed, trustless and anonymous, without centralized institutions for organization and coordination, so consensus mechanisms are needed to help all participants reach consensus and ensure network security and sustainability. The network security and sustainability we refer are twofold layers. The first layer is the security and sustainability of the infrastructure network formed by the interconnection of different devices, that is, whether devices can form an infrastructure network and ensure its secure and normal operation. This belongs to technical issues that the project side needs to fully evaluate before launching the DePIN project. The second layer refers to network security and sustainability at the blockchain economic activity layer, including verifying the authenticity of physical world DU and the reliability of on-chain DU data. As shown in Figure 3, the economic activity data on the blockchain can only guarantee immutability after being on-chained, but cannot guarantee the authenticity of the on-chain data. For example, if the device-side data is tampered with and falsified before being on-chained, then the data, after being on-chained, can only guarantee that the data will not be tampered again, but cannot guarantee that the data is authentic. Therefore, we need the role of verifiers to verify data authenticity before chaining the device data. Only data recognized by all contributors can be on-chained to ensure the sustainability of the ecosystem.

The discussion of the consensus mechanism here is only for the second level, namely network security and sustainability at the blockchain economic activity layer, consisting of two aspects: First, the fairness and accuracy of on-chain bookkeeping, which is the foundation and lifeline of decentralized collaboration; Second, the authenticity of various nodes or data on the network, so as to prevent wrongdoers from changing node locations or sending false data to defraud ecological rewards. The former is an issue that the project side needs to consider when preparing to build its own blockchain, such as PoW or PoS consensus. The latter is what all DePIN project parties need to consider in designing consensus mechanisms from a technical and algorithmic perspective. For example, the Arkreen project adopts the Proof of Green Energy Generation (PoGG) consensus mechanism, with roughly the following process: First, all DUs sample PoGG data every 5 minutes and cache it locally, reporting 12 records to the Arkreen Network every 1 hour. Second, after the end of the previous reward cycle, the Arkreen Network uses a VRF (verifiable random function) method to generate a random value, combined with the current cycle DU attributes, to screen out miners who have the opportunity to earn rewards in the current cycle. Next, the Arkreen Network verifies the credibility of the PoGG data and eliminates DUs judged to have forged data. Finally, rewards for the current cycle are allocated according to the weights of eligible DUs. Through the above PoGG method, Arkreen ensures the authenticity and reliability of network data. In general, the design of the DePIN consensus mechanism needs to follow these principles:

- DePIN consensus mechanism design follows the Proof of Physical Work principle

- Proof is the consensus method, Physical Work is the consensus object, such as Helium's Physical Work is Coverage, Filecoin's Physical Work is Replication and Spacetime

- To achieve system self-organization and maintain system sustainability, the Physical Works required for the DePIN project need to be repeatedly demonstrated

- There is no optimal solution for Proof design, which needs to be designed from technical and algorithmic levels, and the methods for verifying Physical Works need long-term iteration and validation

- All consensus rules are embedded in the DU chip, and the consensus process is completed automatically without any operation by the DU owner, but the authenticity and reliability of the consensus process can be verified by anyone.

D. Contributors

Contributors are usually divided into the following 6 categories:

- DePIN project initiators: DePIN usually has an institution or several people as project initiators. They are responsible for early DU technology development, system development, on-chain contract deployment, DePIN community development, etc. In token distribution, DePIN project initiators reserve a certain percentage of tokens as a reward.

- DU owners: DU is a standardized small device purchased through designated channels in the community. DU owners are also known as miners. According to common goals, DU owners can install devices at locations with higher returns at present to participate in network construction, a process known as DePIN mining.

- DU authenticity verifiers: In a trustless environment, it is very important to ensure that the devices held by different miners operate normally according to system rules. This has a very important impact on the stability of the physical infrastructure network. Simply chaining the device data can only ensure the immutability of the data after being on-chain, but cannot guarantee the authenticity of the on-chain data. Therefore, the role of verifiers is needed to participate in verifying the authenticity of device data in accordance with special rules. Only data recognized by all contributors can be on-chained to ensure the sustainable development of the ecosystem.

- Community governors: Fairness, openness, and transparency are very important in governance under decentralized collaboration. To prevent governance misconduct, governors usually need to mortgage a certain number of tokens. Governance rights are related to the staked token quantity and staking duration, realizing a strong binding relationship between the interests of governors and the ecosystem.

- Project investors: As with traditional businesses, projects still rely on the support of external investment institutions for the project initiator's expenditures in technology and business during the early stage before token issuance. Investment institutions are usually rewarded with the project initiator's equity or project token allocation. For equity, investment institutions need to exit after the project initiator's IPO, or the project side uses future income or equity tokenization to exit through STO offerings. For project token allocations, tokens are typically linearly unlocked over 2-4 years.

- Others: Project sides usually reserve 3-5% of tokens to reward ecosystem advisors, or reward institutions or individuals who discover system technical vulnerabilities. Contributor types may vary depending on project type.

E. Token

If consensus is the foundation of on-chain projects, then tokens are the lifeblood of the economic system. From Web3 project ideas, technical development, to later operation, ecological development, community, etc., all value will be reflected in the token. Using Dr. Xiao Feng's "three generations of tokens" model to understand DePIN projects – NFT is the digital proof of DU, utility tokens represent the usage rights of DePIN, and security tokens represent the equity of real entities (founding institutions, DU manufacturers or others). There are usually one or two utility tokens used in DePIN projects to capture ecological value, with the following characteristics:

- Tokens are usually issued to contributors free of charge through rewards or airdrops.

- The issuance rate of tokens needs to match the growth rate of total economic activity.

- Tokens are used as payment tools or governance credentials in the ecosystem.

- Tokens flow back through transaction fees, repurchases by founding teams, etc. A portion of the backflow tokens are burned according to rules, so that the total supply continues to decrease, realizing the economic system being in a deflationary state.

- The value captured by tokens comes from real-world assets (RWA). Prices fluctuate due to high frequency secondary market transactions. To allow participants to focus on the economic activities themselves, the asset and currency functions of tokens are usually separated to isolate the impact of price fluctuations on the application side of the market. A typical approach is to anchor a dollar stablecoin for payment, while such stablecoins can only be obtained by burning the utility tokens of the asset function.

F. DAO Community

In a decentralized self-organized DAO model, anyone can initiate various proposals for the development of DePIN projects or participate in decision voting on various matters at any time. To prevent governance attacks, governors participating in proposals or voting are usually strongly bound to the DePIN project. That is, any negative governance leading to losses needs to be borne by the governors. A typical approach is to determine the rights of governors based on the amount and duration of staked utility tokens.DePIN DAO communities typically need to govern the following:

- Voting on the list of qualified DU suppliers

- DePIN technical implementation proposals and voting

- Proposals and voting on parameters affecting the DePIN economic model

- Economic model iteration proposals and voting

Economic Model

In the internet platform economy, people are used to discussing business models, but rarely discuss economic models. Some even confuse the concepts of business models and economic models. However, in Web3 economic systems, we can see the essential difference between the two concepts, because each Web3 project has its own monetary system. In Web3 projects, the business model describes how a project creates, delivers and captures value, while the economic model describes the supply and demand model of the token itself and the monetary policy model. The Web3 economic model and business model are not independent, because the economic model needs the business model to carry it, while the business model determines how to regulate the economic model. Dr. Zou Chuanwei, Chief Economist of Ontology, divides the design of economic models into the following steps:

- Think about the economic story

- Refine the "scaffolding" of the economic model

- Determine the objects of tokenization and use cases, including payment tools

- Determine the financing mechanism for public goods

- Formulate incentives for each participant in a decentralized, trustless environment

- Determine the effectiveness of value capture

- Choose the secondary market for the token and assess its impact

- Refine the details of the economic model and iterate continuously based on user needs and risk controlIn designing the DePIN economic model, the following 9 questions help projects and professionals think about how to design an economic model:

- What is the project's roadmap?

- What goods are supported for circulation on the network?

- Who are the providers and demanders of related goods? What are their goals for maximizing benefits?

- What is the role of the token in the circulation of goods?

- How is the token issued? How to reflect the Proof of Physical Work principle?

- What are the uses of the token? And how does it flow back?

- How to incentivize early contributors?

- What purposes are expected to be achieved through the DAO?

- What instability factors exist in the network?

IV. Summary

DePIN captures the value of physical infrastructure in the form of real world asset (RWA) through tokens. In a bottom-up self-organized way, it attracts users through economic mechanisms and gives full play to the economies of scale of the distributed economy. In comparison, DePIN is still at a very early stage, and its business model and economic model are expected to evolve rapidly. Although DePIN shows us many possibilities, it is not omnipotent. By studying early projects like Helium and Filecoin, we can find that there are still challenges needed to overcome in existing business models and technology barriers, and it is not applicable for all scenarios. To summarize:

- DePIN is suitable for single infrastructure scenarios, avoiding multi-scenario iteration, i.e. avoiding "having it both ways". Since DePIN involves interactions between physical devices, project goals and participation rules should be simplified as much as possible to reduce the threshold of understanding, avoid deviations in understanding due to complex rules, and avoid situations where contributors' behaviors run against the overall project goals.

- If there are links involving human management and operation in the construction of physical infrastructure networks, the DePIN model is not applicable. From the perspective of the four flows in the supply chain (trade flow, logistics flow, capital flow, information flow), only the logistics part of the DU buy-sell link can be completed on the chain to reduce friction in building distributed physical infrastructure networks. Each additional off-chain activity means that some friction in DePIN economic activities needs to be resolved in a centralized manner, which may weaken the economies of scale of distributed business.

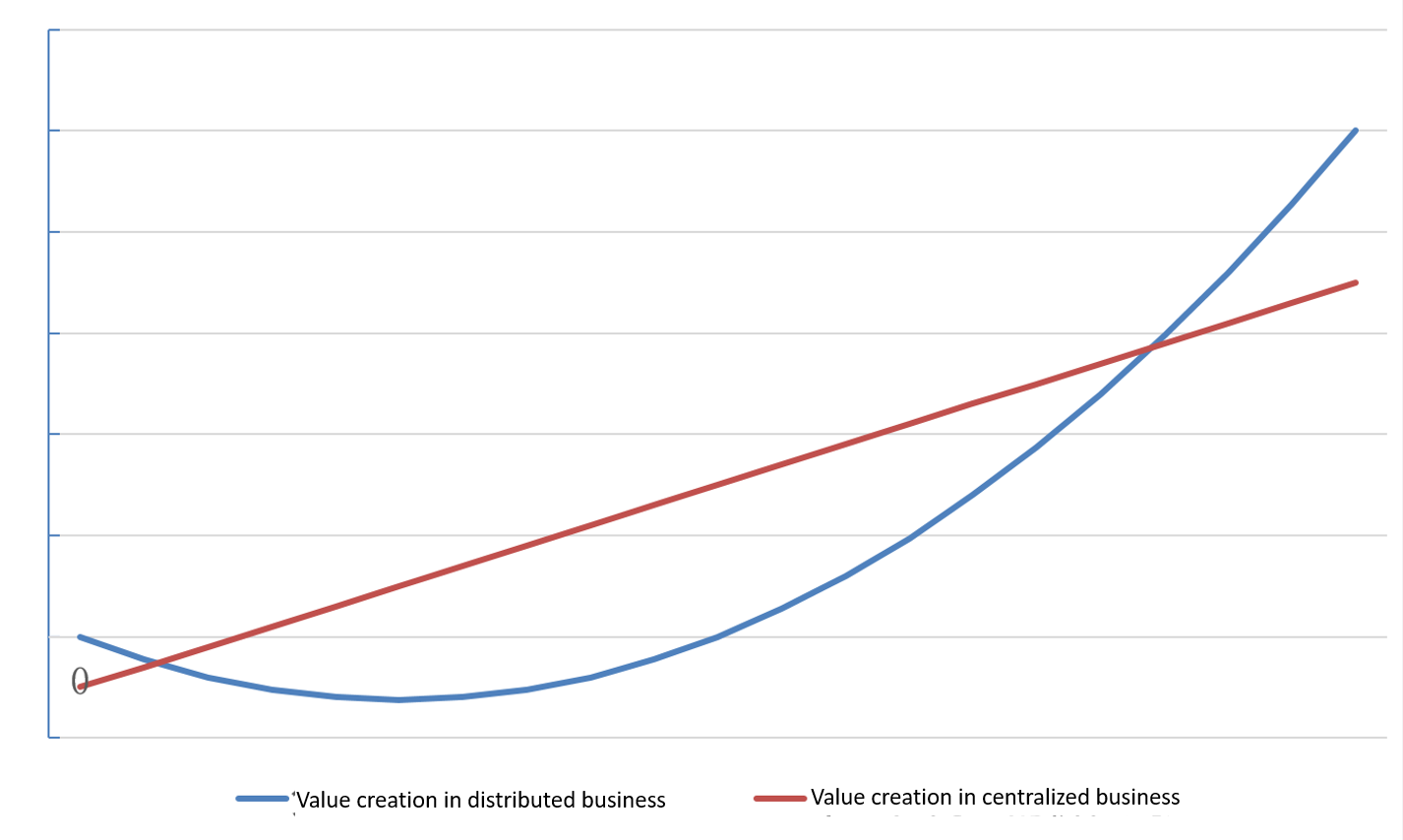

- In the initial stage of project development, it is difficult to demonstrate the economies of scale of distributed economies. Only when the network exceeds a certain threshold (called the "critical mass") , it can demonstrate the advantages of distributed organizations in scale expansion and value creation. As shown in Figure 4, only after reaching the critical mass (second intersection of the two lines) can the advantages of distributed organizations in terms of scale expansion and value creation be realized. Therefore, before reaching the critical mass, DePIN projects still rely on the core team to deploy DePIN nodes and promote the network in a weakly centralized manner. After reaching the critical mass, the core team usually transitions to community, and network governance is simultaneously handed over to community governance for growth in a distributed manner, thus increasing network effects.

In addition, the current development of DePIN is still limited to the network construction stage, and universal application on the demand side has not been enabled. In the future, it remains to be seen what kinds of problems and bottlenecks DePIN projects will encounter in advancing the demand side before the business and economic loop of the DePIN ecosystem can be truly connected.

Source: Foresight News

If you are interested in DePIN you can learn more about the latest developments in the sector and compare projects by visiting DePINscan. DePINscan powered by W3bstream and IoTeX is designed to empower intelligent investors in the DePIN sector.