DeFi on IoTeX 101: DEXs, Yield Farms, and Money Markets

Over the past year, decentralized finance (DeFi) has taken the world by storm with almost $200B of total value locked (TVL) right now in DeFi apps. By popular demand from the IoTeX community, we have been preparing for a wave of new DeFi apps launching on IoTeX, including DEXs, yield farms, and money markets. As we charge towards our vision for the Internet of Trusted Things, we can't wait to welcome new and innovative DeFi partners to the IoTeX Network.

The IoTeX blockchain is lightning-fast (5 sec blocks with instant txn finality), cheap (ooo's of txns for <$1), and interoperable with top blockchains like Ethereum, BSC, and Polygon. These qualities make IoTeX an incredible foundation for DeFi, which is already live and ready to grow rapidly:

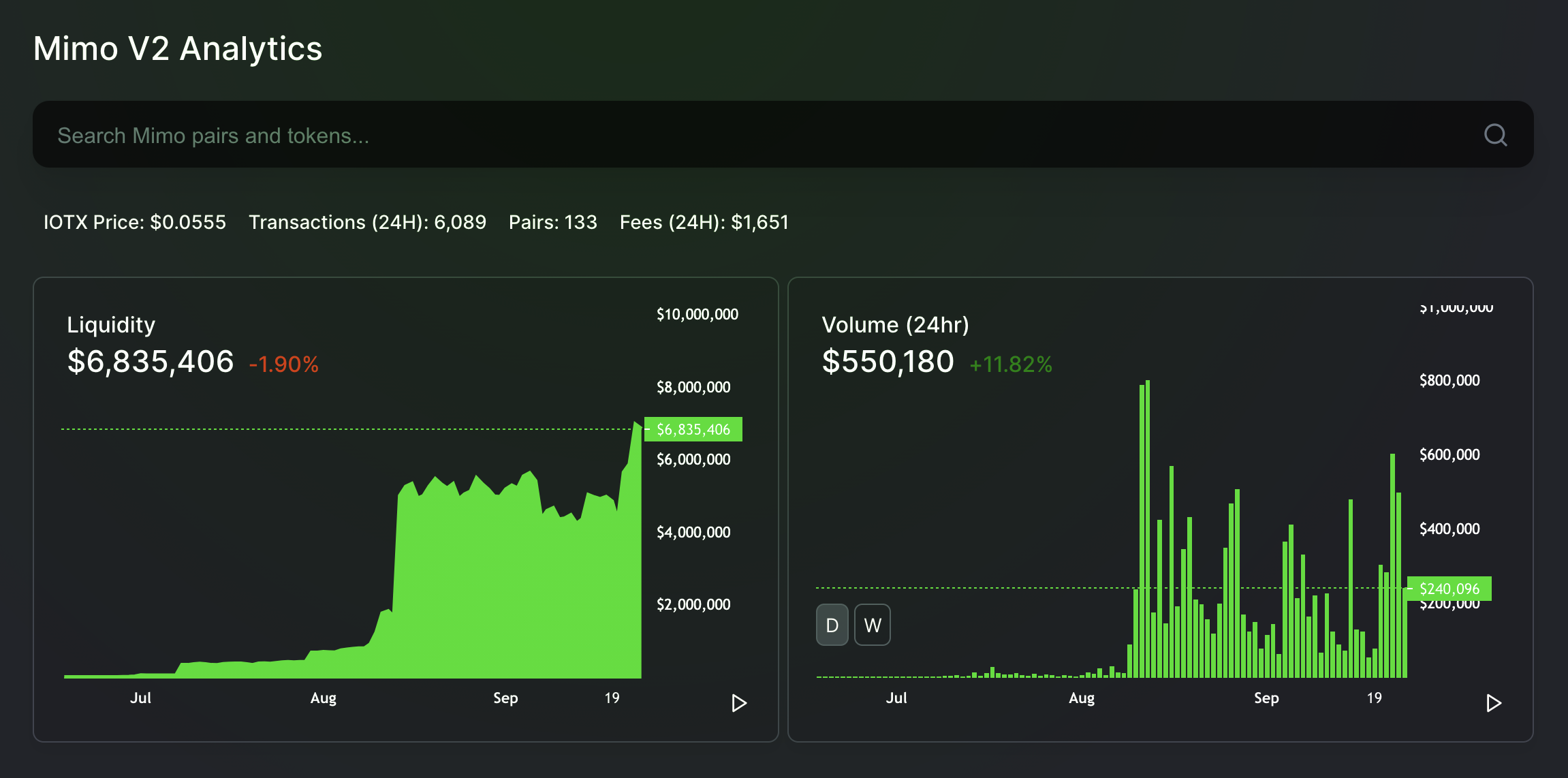

- mimo is a DEX that has been live on IoTeX since mid-2020, enabling decentralized trading of IOTX + XRC20 + cross-chain assets. To date, mimo supports 30+ assets and will soon launch a governance token.

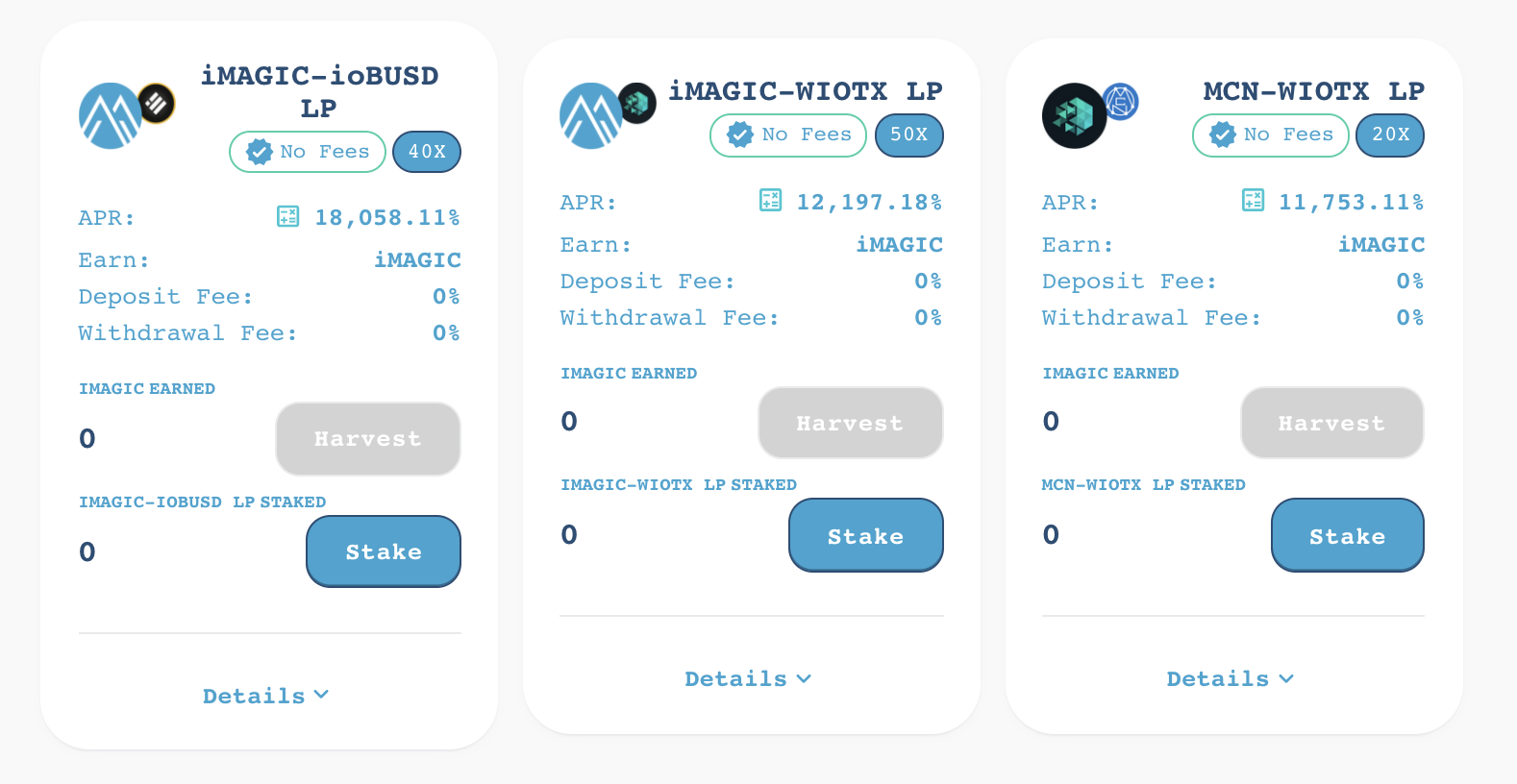

- Magic Land recently launched as the first yield farm on IoTeX, reaching $8M in TVL within two days. New yield farms ZoomSwap & Firebird are also expected to launch soon -- each yield farm having its own governance token.

In this blog, we share an overview of DeFi on IoTeX as well as best practices for new users.

Various Flavors of DeFi on IoTeX

DeFi is growing by the day, replicating the traditional finance industry in a decentralized fashion. This comes in many flavors – below we share an overview of DEXs, yield farms, and money markets. We also highly recommend you read our recent blog on new transparency/audit tools you can use to stay safe when exploring new DeFi projects.

DEX - Liquidity Providers

Decentralized exchanges or DEXs (e.g., mimo) are automated market makers (AMMs) that manage liquidity pools, which aggregate assets from liquidity providers "LPs" that deposit token pairs in "pools" in order to earn interest. Traders can swap tokens within the pool, and pay fees typically ~0.3% of trading volume that is split proportionally by LPs. As tokens in a pool are traded the AMM will rebalance the supply/ratio of tokens in a pool; due to this, there is risk of losses for LPs call impermanent loss that all LPs should understand. An LP's share of a pool is denominated in "LP tokens" – users can withdraw their share of the pool at any time by exchanging LP tokens for the originally deposited tokens. These LP tokens can also be staked in yield farms to earn additional interest.

Yield Farming

Yield farms (e.g., MagicLand, Zoomswap) enable users to stake and lend tokens in exchange for yield in the form of other tokens. In short, yield farms incentivize DEX LPs to stake their LP tokens in a new yield farming pool. Farmers will earn interest as a reward for providing liquidity, but will not earn any LP rewards until they withdraw their LP tokens. Yield farms typically calculate the estimated returns of various farms in annual percentage yield (APY), which is the rate of return over the course of a year with compound interest factored in. Yield farms emit a fixed amount of rewards each block, which are split proportionally by all LP token depositors – as more LP tokens are added to a yield farm, the APY for each individual farmer will decrease accordingly.

Money Markets

Money markets (e.g., Aave, Curve) enable users to lend and borrow crypto assets. Similar to bank loans, lenders earn interest for temporarily giving up ownership of their assets, while borrowers pay interest to temporarily hold an asset. Lenders provide liquidity to the market to earn interest payments, while borrowers post collateral and pay interest in order to borrow assets. Depending on the supply and demand for assets, the lending/borrowing % rates will fluctuate. We look forward to welcoming the first money markets on IoTeX soon!

What's Next?

In the next few months, we plan to onboard a variety of new projects including DeFi blue-chips to the IoTeX Network. We have had promising conversations on the intersection of DeFi and real world devices – a concept we call #MachineFi – with an exciting set of new partners. We can't wait to share what we've been up to.

DeFi is still in its infancy, and new projects can be complex and carry financial risk for borrowers, lenders, and traders alike. When exploring DeFi on IoTeX, we highly recommend you review our DeFi transparency/audit tools, as well as other publicly available tools like impermanent loss calculators and yield farm ranking websites. Most notably, any new projects in/outside of DeFi are susceptible to hacks and fraud due to vulnerabilities in smart contracts. Make sure to only use DeFi projects that are audited and trustworthy – happy DeFi'ing on IoTeX!

About IoTeX

Founded as an open-source platform in 2017, IoTeX is building the Internet of Trusted Things, an open ecosystem where all “things” — humans, machines, businesses, and DApps — can interact with trust and privacy. Backed by a global team of 30+ top research scientists and engineers, IoTeX combines blockchain, secure hardware, and confidential computing to enable next-gen IoT devices, networks, and economies. IoTeX will empower the future decentralized economy by “connecting the physical world, block by block”.

Learn more: Website | Twitter | Telegram | Discord | Reddit | Blog