What are Real World Assets (RWA) and DePIN?

What is RWA?

The crypto industry loves to assign clever acronyms to things and then slowly wait for these acronyms to take hold, first through the crypto "space" and then in the broader, non-crypto zeitgeist. "RWA" or real world assets is a perfect example of an acronym that's beginning to reach this second level of awareness and perception. In other words, RWA's time has come. And at IoTeX, we believe (as Victor Hugo did) that there's no force on Earth more powerful than an idea whose time has come.

At its core, "real world assets" simply means the tokenization of an asset on a blockchain. This is generally accomplished by issuing a fungible or non-fungible token that represents the underlying asset and is tied to it in some way (usually via unique device identifiers embedded during the manufacturing process or with legal contracts). Up next, we'll dive into the real world asset industry landscape as it stands today.

The real world asset industry landscape

So as not to waste good work, I'll stand on the shoulders of giants here and reference "An Unreal Primer on Real World Assets" by Teej Ragsdale, Jack Chong, and Mukund Venkatakrishnan. The below industry map encompasses most of the RWA sector as it currently stands. Orange circles represent infrastructure players, green circles reference asset specialists.

Another way to broadly segment the RWA industry is by grouping the tokenized assets into tangible and intangible groups. Tangible assets are those made of physical matter, like a car, fine art, or real estate properties, and are often relatively illiquid assets. Intangible assets are those that are not made of physical matter, like U.S. government bonds, a patent, or securities owned by financial institutions.

Throughout the rest of this blog, we'll be mostly focused on tangible assets on-chain as they're most relevant to the construction of decentralized physical infrastructure networks (DePINs). But before we discuss DePINs and how they're related to real world assets, let's explore why you should even care about real world assets in the first place.

Why should you care about real world assets?

Tokenizing real world assets allows for:

- Increased asset liquidity

- Real world assets can be bought, sold, and exchanged 24/7/365, unlike in much of the traditional finance world

- RWAs allow for fractional ownership, or the ability to have their ownership split into many pieces. All else equal, this improves the likelihood that an asset can receive debt financing

- Reduced costs

- The utilization of public, permissionless blockchains allows for the removal of intermediaries, middlemen (traditional finance giants), and their take rates

- All else equal, the more middlemen that can be removed from a transaction, the cheaper it will be for all parties involved

- Increased transparency and trust

- By utilizing blockchains as public, immutable ledgers, asset transactions gain transparency

- This increased transparency means transacting parties can establish trust more easily than in traditional markets with traditional assets

Real world asset tokenization increases the asset's composability, or ability to be easily tapped for a variety of important use cases like lending/borrowing, ownership and identity, and gated access. Now that we've explored the benefits of tokenizing real world assets, let's briefly cover decentralized physical infrastructure networks on their own before we discuss how RWAs play a role in DePINs today.

What's DePIN?

DePIN stands for Decentralized Physical Infrastructure Network. It's a new way to build and maintain infrastructure in the physical world, utilizing token incentives and governance rights to motivate contributors to build a network from the ground-up, in a decentralized way.

For an in-depth primer on DePIN, check out our recently published blog here.

Why is DePIN important?

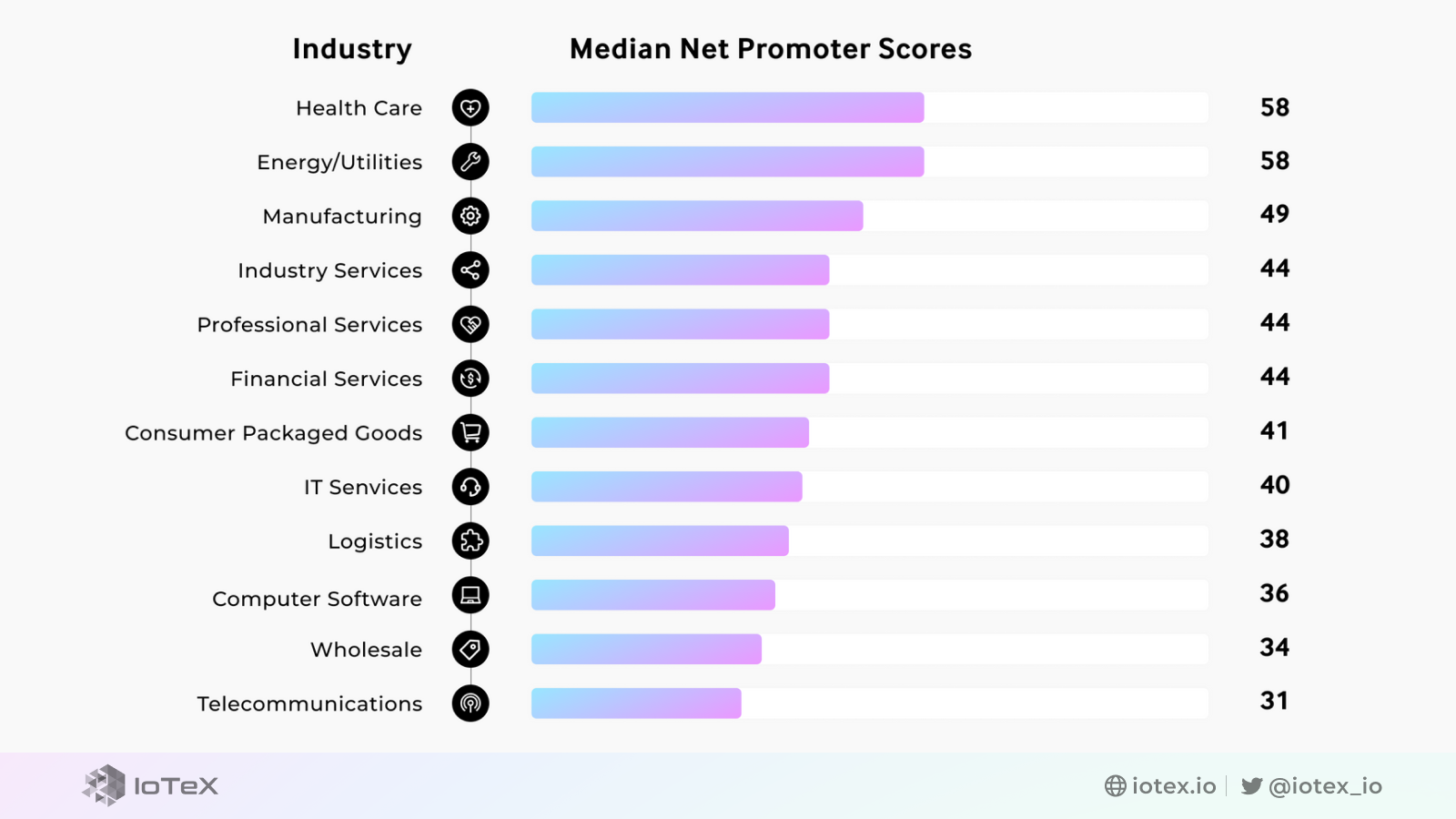

DePINs bring innovation to large, archaic, oligopolistic markets like telecom and energy. They use blockchain technology to aggregate and coordinate latent supply for a service or good.

By doing so, they increase the number of "suppliers" in a market, allowing for increased innovation and competition. This reduces costs to end consumers and creates net new use cases from the collection of more, better data.

As you can see from the picture below, the customer satisfaction for many of the most centralized oligopolies (like telecom) is incredibly low. DePIN should help solve this by removing the power oligopolies have over their customers.

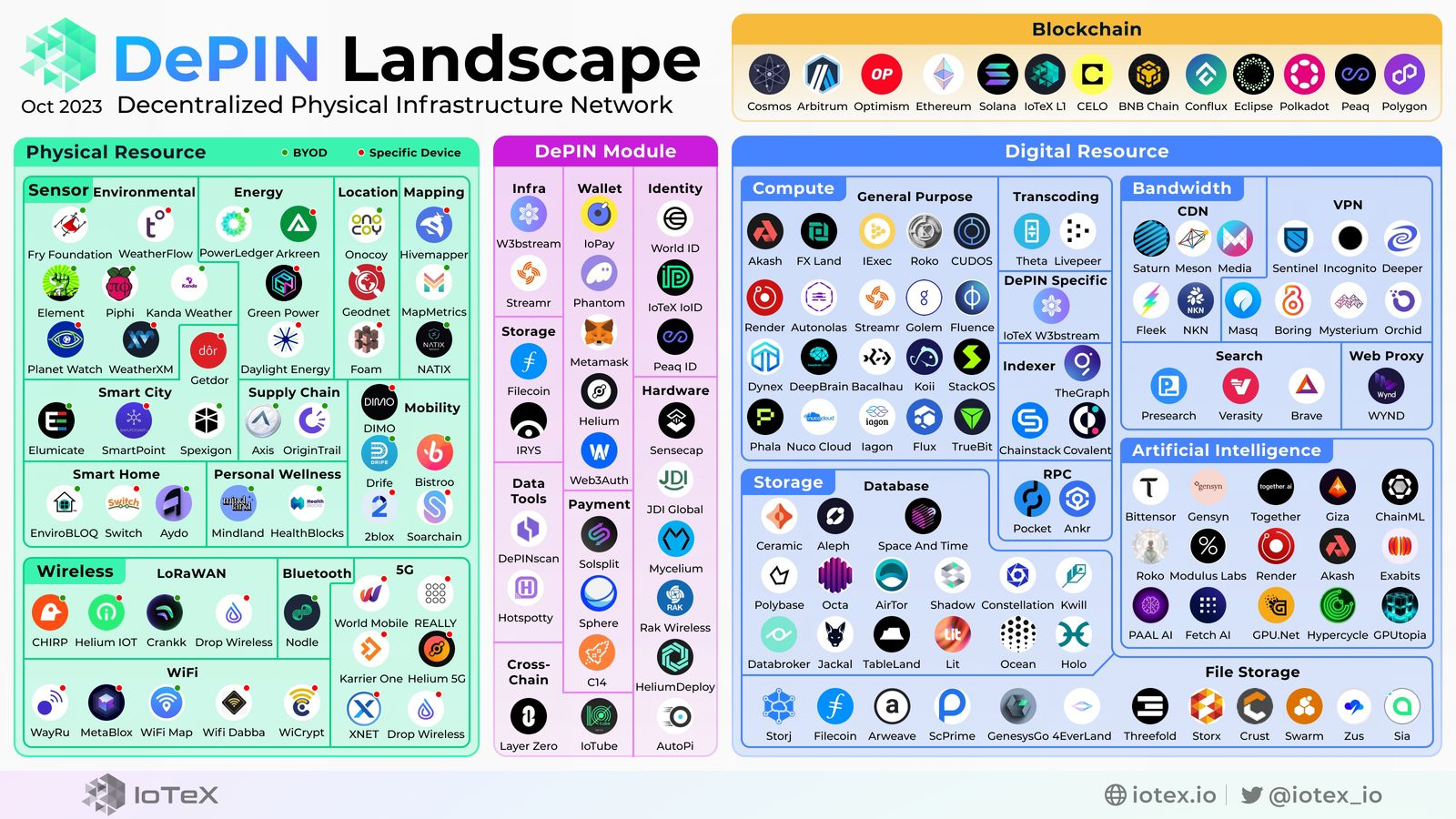

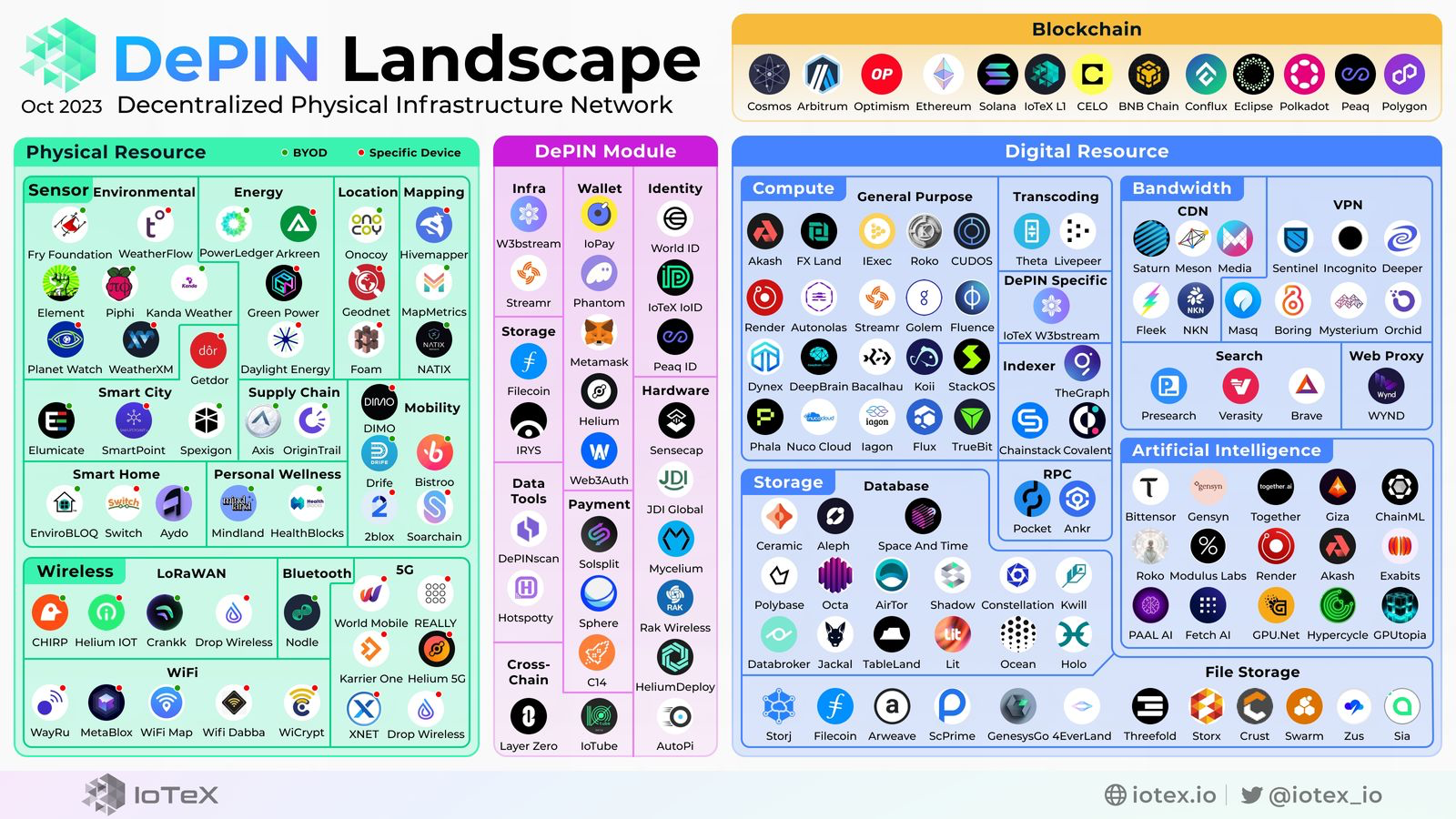

The DePIN industry landscape

Now to reference our own work as DePIN industry veterans, the below picture lays out the burgeoning DePIN sector across broad categories like server-based projects, infrastructure (including IoTeX and our W3bstream middleware), sensor-based projects, and the wireless space.

How do real world assets enable DePIN?

Given that the premise of DePIN is to build networks of physical assets in a decentralized manner for the provision of a service or good (like wireless connectivity or energy transfer), real world assets and their on-chain representations are critical building blocks of any DePIN.

Devices in a DePIN network can be represented on-chain as NFTs and relevant data about their physical location, device type, uptime, etc. can be attributed to each device. Data generated by devices is DePIN-specific but can include things like car mileage driven (DIMO), number of open parking spots in a lot (Natix), or gigabytes of cellular data used (Helium). This data can also be attributed to the RWA via its' on-chain digital twin.

If and when these data streams are used or monetized, these actions can be recorded on the blockchain and the associated device(s) and their owner(s) can be compensated on-chain. This functionality creates the DePIN feedback loop, which allows real-world activity to influence on-chain activity, and vice versa.

How real world assets are integral to the DePIN feedback loop

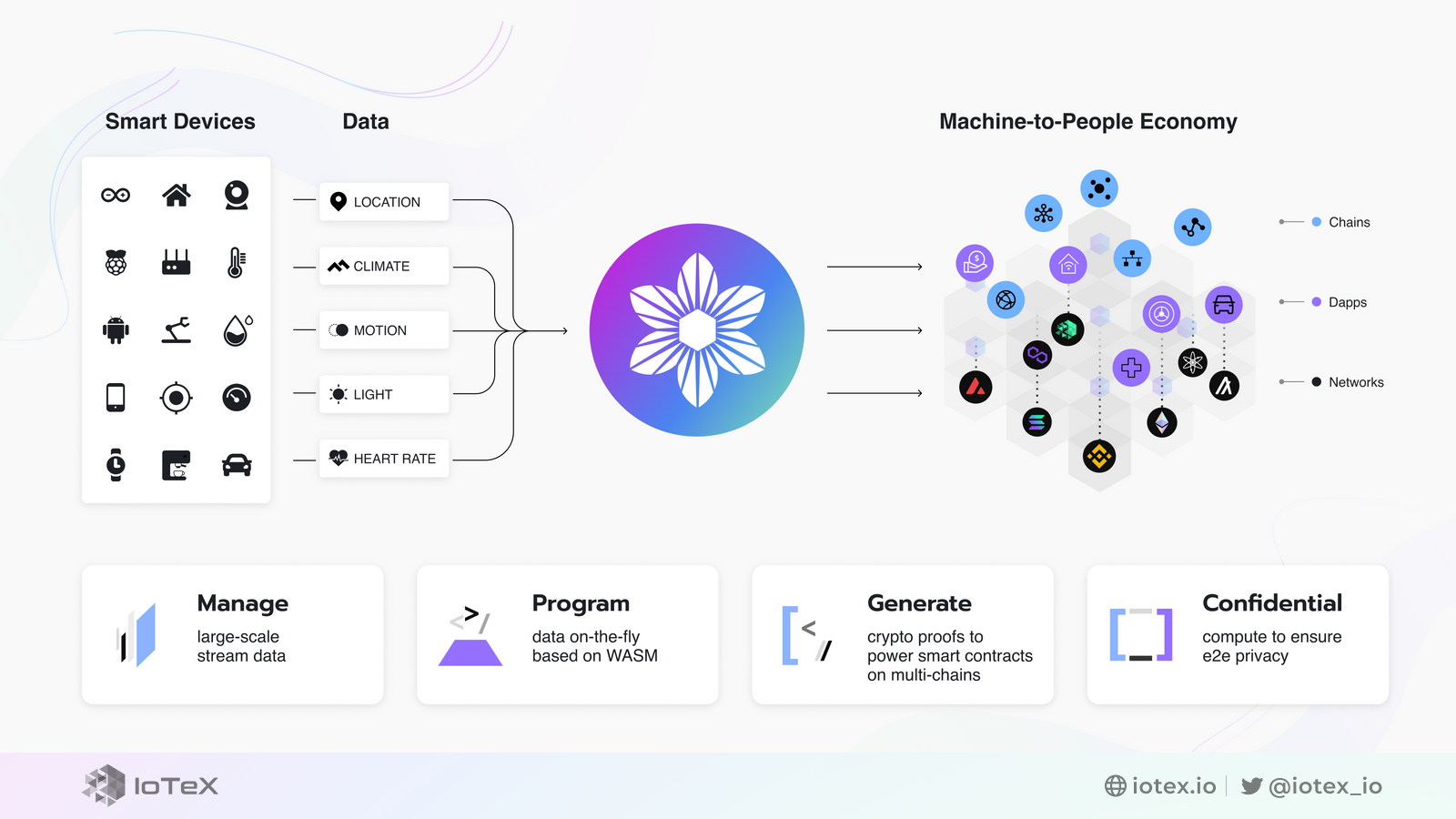

The economic activity facilitated by a DePIN results in a feedback loop that results in the following flow of data. DePINs need to:

- Source data from their networked devices

- Stream this data to the Internet and run compute on it (applying business logic, tokenomic rules, etc.)

- Generate smart contract-ready proofs from these computations and output them to blockchains to trigger things like token incentive distribution, NFT mints, etc.

- Allow on-chain data related to contributor reputation, contributor contribution, and economic activity to be seen by (and therefore affect) the "real world"

As you can see above, tokenizing real world assets is integral to each step of the above feedback loop. In step 1, networked devices need identities on chain to attribute data to. In step 2, these on-chain identities need to be able to be involved in computations run on the data they provide. In step 3, they need to be linked to a variety of smart contracts on blockchains to ensure their participation in the token economy for their DePIN. And in step 4, they must be able to receive feedback from the smart contracts associated with their DePIN to then modify their behavior or activity in the real world. By enabling this feedback loop, real world assets allow DePINs to create functional token economies.

DePINs create two-sided token economies from real world assets

DePINs are pushing the RWA space beyond its current focus on highly liquid, intangible assets (like U.S. Treasuries) towards less liquid, tangible assets that can benefit even more from representation on chain. DePINs are the next evolution of RWA because they create physical networks of real world devices, leverage the benefits of their on-chain representation, and form entire token economies around them.

These token economies are, of course, two-sided. On the supply-side of a DePIN, contributors use hardware (such as mobile phones, cellular radios, or even mapping-capable cameras) to contribute in some way to a network (tagging of public Wi-Fi hotspots, provision of cellular connectivity, contribution to a Google Maps-esque view of the street). These contributors do so because they are rewarded with token incentives and some level of governance rights over the network they are helping to build.

On the demand-side of a DePIN, users pay for services provided by the DePIN in either the project's native token, or more frequently, in fiat that is then used to buy and burn the project's native token so that the economic value exchanged in the transaction accrues to the project and therefore its contributors and token-holders.

To illustrate this in elaborate detail, we'll use a Helium Wi-Fi hotspot as an example of a real world asset within a broader DePIN network.

RWAs x DePIN in action

Representing real world assets in a DePIN on-chain provides the network with the benefits of tokenization mentioned in the introduction above. I'll use Helium's new Wi-Fi hotspot as an example here. But before I dive into this example, let me provide some context.

Helium is a DePIN project focused on building out wireless connectivity in a decentralized way. They started out building a network for IoT (Internet of Things) devices, then added a cellular network, and are now entering the Wi-Fi space. They're one of the largest and oldest projects in the DePIN industry and were the first to popularize the use of token incentives to build a physical network from the ground up.

Helium Mobile is Helium's consumer-facing cryptocarrier. By cryptocarrier, we mean that they're using the same token-incentivized model to motivate contributors to buy and install Helium cellular radios, creating cellular coverage for your phone using the unlicensed CBRS band and eSIM technology. But given that it will take them years to reach the level of scale that AT&T or Verizon have, they've partnered with T-Mobile so that Helium Mobile subscribers can use the T-Mobile network when they're not in range of a contributor-deployed Helium Mobile cellular radio. Their initial cellular plan costs just $5 a month and includes unlimited talk, text, and data.

Now back to our example. The device in question here is roughly the size of a tissue box, costs $250, and provides Wi-Fi coverage indoors for Helium Mobile subscribers. It earns tokens for being online and when it is used to provide Internet connectivity. Here's how tokenizing this real world asset benefits Helium, the DePIN (note that some examples are illustrative, but all are currently possible).

Let's pretend that there's a group of investors who want to collectively fund the purchase and deployment of a Helium Mobile Wi-Fi hotspot. Because the device is represented on-chain via an NFT, it can be bought or sold at anytime, permissionlessly, with the physical device being shipped separately (one is useless without the other). The NFT is bound to the physical device via a private key sitting within the device itself that's implanted during manufacturing. Token rewards accrue on the device NFT itself and are redeemable by the wallet(s) that own(s) the NFT.

Given that there are multiple owners here, the NFT can be fractionalized, allowing for several investors to fund the purchase and deployment of the device and then all receive token rewards from it equal to their proportional contribution to the device's deployment. By leveraging a simple multi-signature wallet, the investors could remove the need for an escrow service and lessen any related legal fees given the trustless and permissionless nature of the blockchain technology they're utilizing. And finally, the investors don't even necessarily need to know or trust each other fully given the usage of blockchains as a transparent, immutable ledger for all on-chain activity related to the device (including its ownership, uptime, location, usage, earnings, etc.) While this was an interesting hypothetical example of RWAs and DePINs in-action, IoTeX is currently working with projects in both sectors, today!

IoTeX's work with real world assets

IoTeX is the go-to blockchain infrastructure provider for any company looking to represent physical devices and their data (and do something with that data) on-chain.

As an example of our current involvement with real world asset companies and use cases, we've recently been working with Western Engineering, a hardware and software company based in Italy that's focused on energy and microgrids. In Italy, there's government support for the creation of CERs. CERs are renewable energy communities, or microgrids, where neighbors in a town or city with the ability to produce energy (primarily via solar panels) can band together and share this energy with each other, reducing energy loss via long-range transmission and improving energy efficiency. In Italy, there's a government-owned company called the GSE that tracks energy exchanges within and between CERs and the grid and then financially settles these energy exchanges once a month.

Western Engineering currently has 50,000 smart inverters worldwide that can measure the production and consumption of energy within a home. Their Westernchain portal allows for the easy creation and management of CERs in Italy (and hopefully one day other countries as well). It includes dashboards for energy generation and consumption and records this information immutably on the IoTeX Layer 1 blockchain.

We're working with Western Engineering to build out the entire blockchain portion of their Westernchain portal, meaningfully improving their product and bringing the power of blockchain technology and digital assets to Western Engineering's work with real world assets. To take things a step further, read on to hear about our work with the DePIN sector and the most exciting projects within it.

IoTeX's work with DePINs

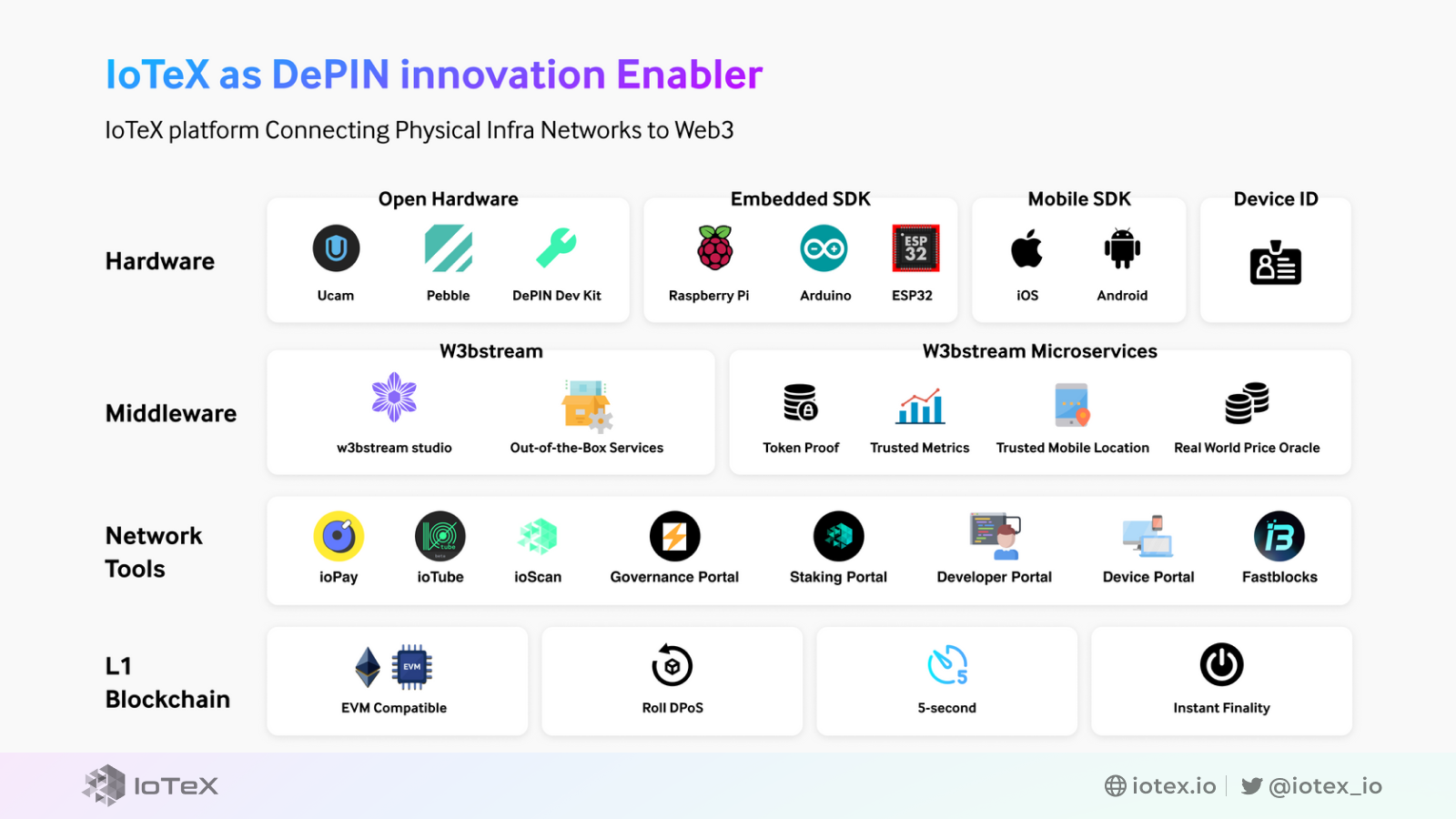

IoTeX is a proud partner of DePIN pioneers like DIMO, XNET, Geodnet, and many others. We enable DePIN innovation and assist ambitious builders by providing:

Decentralized infrastructure:

- IoTeX W3bstream is decentralized, chain-agnostic middleware that connects real-world data from devices to smart contracts on blockchains

- IoTeX L1 is an EVM-compatible, dPoS blockchain purpose-built for real world devices and their data

Developer tools:

Go-to-market support:

- Halo Grants program

- Ecosystem fund

- IRL events

IoTeX has been building at the cutting edge of the intersection between the real world and blockchains since 2017. While the terminology and buzzwords that encompass this intersection may have changed, our focus on connecting devices and their data to smart contracts on blockchains has never wavered.

The recent emergence of decentralized physical infrastructure networks represents a paradigm shift in the way humans think about building infrastructure and we're incredibly excited about the innovation we see occurring in both the real world asset and DePIN sectors! We're proud to be the leading DePIN infrastructure provider as decentralized physical infrastructure networks use the building blocks of real world assets on-chain to build a better, decentralized future.